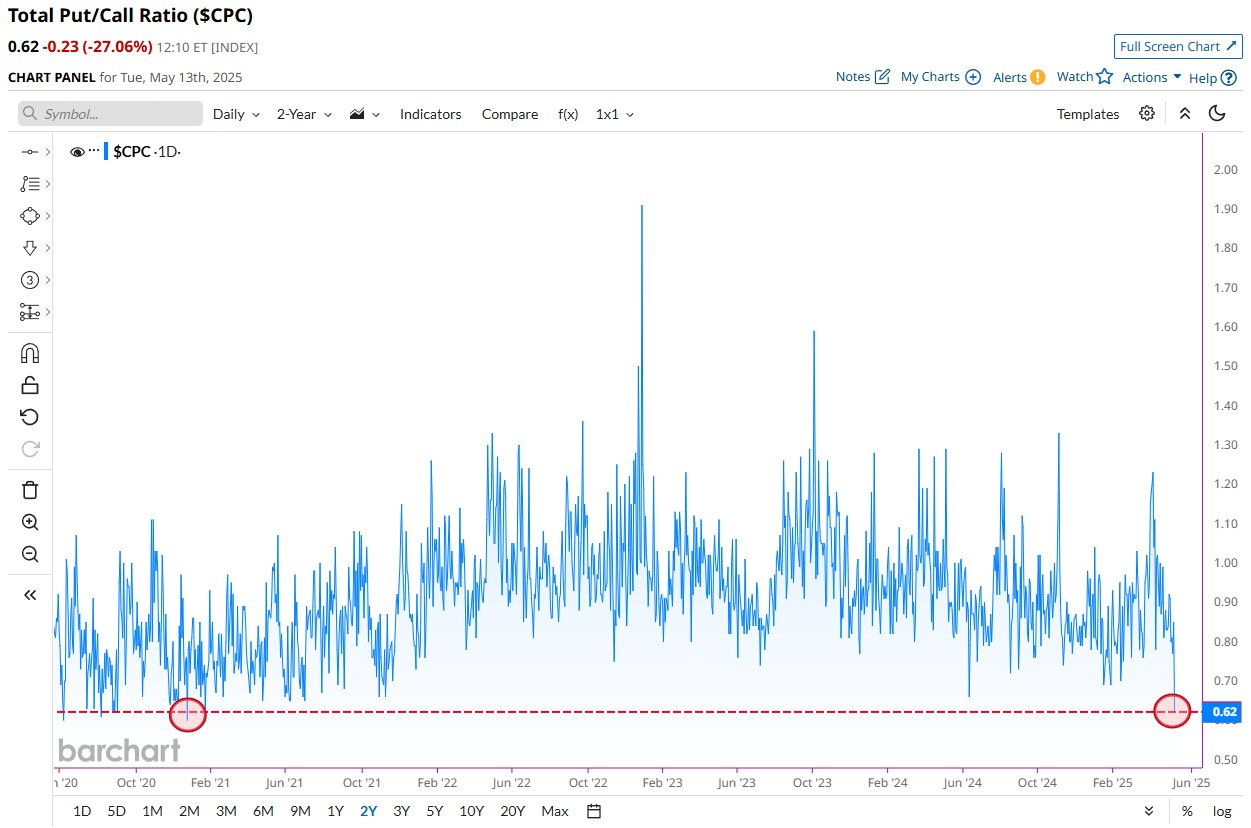

All the bears are hibernating deep in their caves, and everybody is fearless!

As I’ve mentioned a few times, I generally consider the CBOE Put/Call Ratio to be a contrarian indicator, meaning that if investors are buying far more puts than calls, that could signal bottom in the market.

This is especially true if that ratio spikes to a historically significant level (anything 1.2 or higher), like March 2020 and a few other occasions in the past 10 years.

Apparently, though, all the fear that occurred in early to mid-April has evaporated, as the Put/Call Ratio is back to a 4-year low of 0.62!!

Be careful out there! – Chris

If you enjoy these posts, and are looking to improve your knowledge of commodities and other financial markets, please click the Subscribe button that’s below the chart to receive our Daily and Weekly posts.

Thanks in advance! - Chris

(Source: Barchart, 5/13/25)

NOT FINANCIAL/TRADING ADVICE!