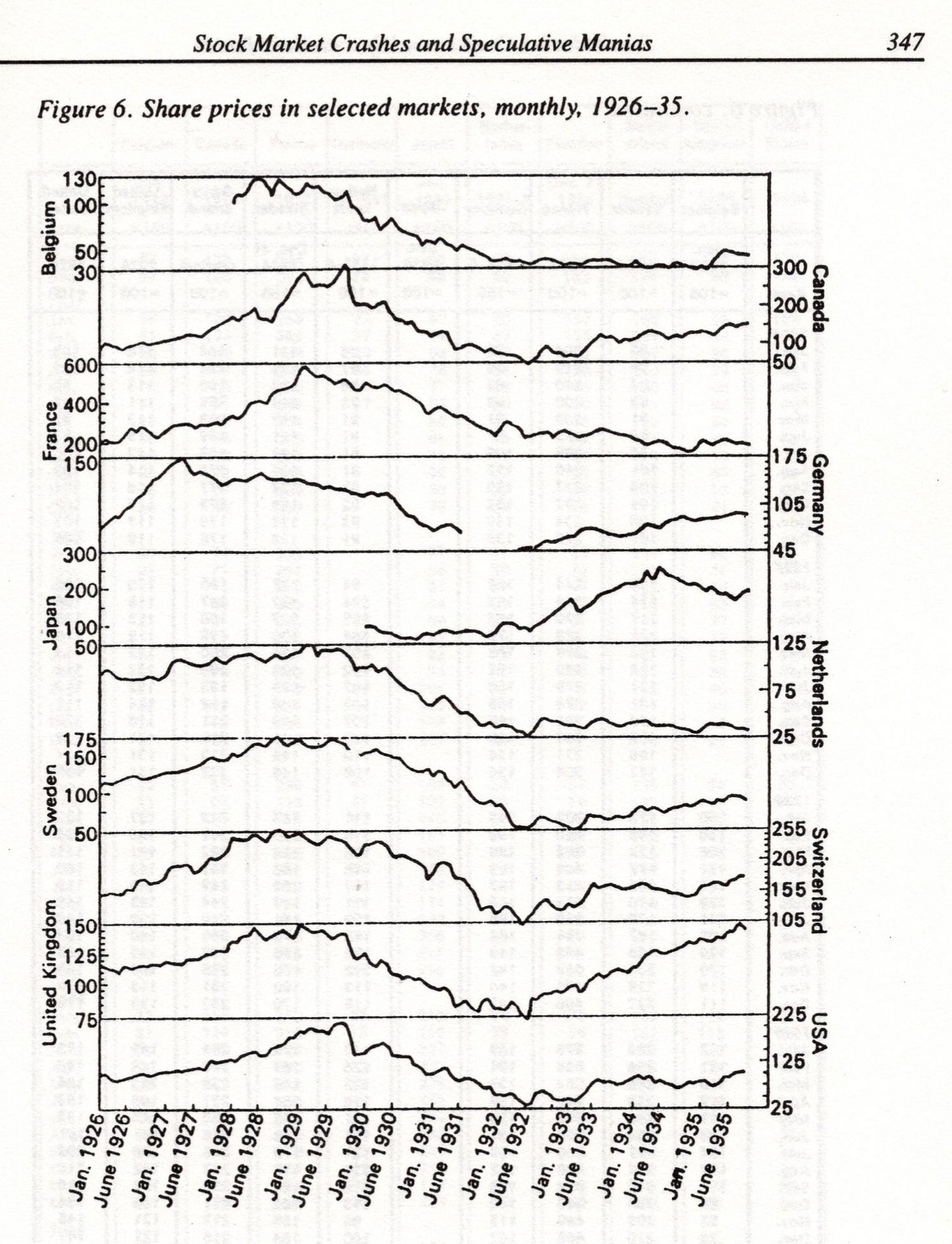

When commentators proclaim that investors are rotating from x group of stocks to y group of stocks, I often remember these charts.

More often than not, these rotations last days or weeks, not years like the Nikkei vs S&P from 1980 to 2000ish.

Also, one-off examples such as this are usually due to endemic problems in one economy versus another, not an overall global economic issue.

Moreover, our economies are becoming more and more globalized and intertwined with each passing day (which actually makes these charts all the more impressive, and suggests the entire world was in a recession/depression in the 1930s, not just the US).

Thus, in the long-run, a rising or falling tide lifts or lowers all boats!!

Please keep this in mind while global stock markets brace for volatility due to tariffs and (potential) trade wars.

Just my thoughts. – Chris

If you are serious about improving your knowledge of commodities and other financial markets, please click the Subscribe button that’s below the snapshots to receive our Daily and Weekly posts.

Thanks in advance! - Chris

(Charts courtesy Stock Market Crashes and Speculative Manias by Eugene N White)

NOT FINANCIAL/TRADING ADVICE!

Smart take, Chris.

Most “rotations” are just knee-jerk flows, not real structural moves. Long-term shifts need real macro drivers rather than headlines.

Global markets move together more than ever. Chasing sector noise is how retail gets burned.

Appreciate the clarity.

My pleasure Rick!!